2020 Wage Garnishment Protections

Legal Lessons: Public Benefits Edition

February 28, 2020

Harvey Savitt, Esq.

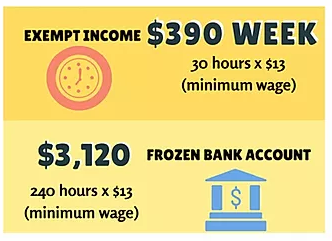

March 2, 2020As of January 2020, the minimum wage on Long Island is $13 per hour. With this in-crease, the amount of disposable income exempt from garnishment to pay a private debt is now $390 per week. “Disposable income” means income after deductions required by law, such as taxes or Social Security. Other non-mandatory payroll deductions such as health insurance premiums still count towards disposable income.This means that clients with employment in-comes less than $390 per week are exempt from private debt collection. (30 hours x $13 (minimum wage) = $390 a week (after taxes). CPLR §5231. The frozen bank account exemption increased to $3,120 (240 x $13). CPLR 5222 (i).For those with higher incomes, the limits on garnishment are as follows: The lesser of (1) 10% of gross income or (2) 25% of disposable income. However, disposable income cannot be reduced to less than $390 per week.

In addition, many types of income, including disability income and child support, remain exempt. Check LawHelpNY.org for more information about limits on debt collection.